Interview

Analyzing the Evolving Blockchain Landscape With VanEck

Please note that the below summary represents the Token Terminal editorial team’s notes of the interview with Matthew Sigel from VanEck.

For a word-for-word recap, we recommend readers to tune in to the full interview:

Overview

- Matthew Sigel, Head of Digital Assets Research at VanEck, a $100 billion AUM asset manager.

- VanEck has multiple TradFi and crypto investment products, and regularly publishes leading research in the space.

- Topics covered: Bitcoin, Ethereum, and Solana, L2 ecosystems, economic sustainability of L1s, onchain data and investor reporting, and more!

How Have Asset Managers Adopted the Bitcoin Spot ETFs?

- The BTC spot ETFs are among the fastest growing ETFs in history.

- The current buyers, which have now become public as a result of SEC filings, represent US asset managers with an aggregate AUM of $8 trillion or 25% of the AUM of institutional asset managers in the US.

- Consequently, if BTC gets a 1% allocation across institutional investor portfolios, there will be tens, if not hundreds, of billions in new inflows over the coming years. In order for the market to get there, CIOs need to incorporate BTC into their asset allocation models.

What Are the Impacts of a Growing Bitcoin Ecosystem?

- Traditionally, crypto cycles are driven by wealth creation among BTC holders. After a certain USD denominated profit level has been reached, investors start to look for diversification and alternative yield opportunities.

- In the last cycle, it was largely centralized lenders (many of which are now bankrupt) that offered these yield opportunities to BTC holders.

- During this cycle, a key trend is that centralized counterparties are replaced by non-custodial, onchain asset management solutions.

How Should Investors Categorize the Different Bitcoin L2s?

- There are 3 different types of Bitcoin L2s: merge mined chains (BTC L1 miners also mine the L2), L2s that use the Bitcoin L1 for DA (similar to Ethereum L2s), and sidechains (other chains wrapping BTC).

- There are many Bitcoin L2s entering the market right now and differentiation is a challenge at this point.

- From a liquid token buyer’s point of view, it might be too early to identify a category-winner within the Bitcoin L2 sector.

What Is BTC’s Role in the Investor Portfolio?

- In contrast to PoS chains and applications, where tokenholders share in the protocol’s economics, only miners earn revenue in the Bitcoin network. This means that increased onchain activity results in more revenue for the miners.

- The increased economic activity (Ordinals and L2s) has made publicly listed BTC mining companies an attractive part of investor portfolios. These companies currently control ~30% of the global Bitcoin hash rate.

- However, the increased onchain activity has also increased BTC’s share in the MarketVector Token Terminal fundamental index, where the portfolio construction is determined by transaction fees and active addresses. Given the power law in cryptoasset market caps, even without a revenue share to BTC holders, BTC can end up with an outsized market cap by functioning as the reserve asset of an Internet-native economy.

Alternative Paths to L1 Value Creation: Ethereum vs. Solana

- Blockchain revenue: transaction count * avg. fee per transaction (incl. MEV). This means that it’s possible to achieve a great economic outcome also with low transaction fees, assuming the chain facilitates more transactions.

- A rule of thumb regarding MEV (arbitrage): the more economic activity that is conducted on a single L1 ledger, the more arbitrage opportunities arise. Therefore, MEV on Solana L1 > MEV on Ethereum L1.

- This has become evident recently, with Solana’s transaction fees + MEV reaching parity with Ethereum’s.

Will the Solana Ecosystem Eventually Adopt L2s?

- Solana’s publicly stated goal is to scale on the L1. The protocol’s founders have, so far, not been advocating for L2s.

- However, some application developers and investors have talked about the need and/or opportunity for L2s on Solana.

- We can break down the “need” for L2s into three components: throughput, economics, and control. As a high throughput chain, it’s possible that Solana will see L2s for different reasons than chains like Ethereum. For example, because developers of widely adopted applications want to (i) improve their economics and/or (ii) have more control of the technical implementation and roadmap of the ‘chain’ they’re building their businesses on.

Is the Ethereum L2 Sector a ‘Winner Takes Most Market’?

- As most market sectors in crypto, the Ethereum L2 sector is likely to be a ‘winner takes most market’. However, it’s difficult to assert whether the winners are already in production today or have yet to be launched.

- The L2 token supply overhang is also an important input for L2 token valuations. There are investors who argue that even the most widely adopted L2s are overvalued from a fundamentals point of view.

- One noteworthy aspect of Ethereum’s L2-focused strategy is that it moves both (i) assets and (ii) transactions away from the L1 and thereby “deteriorates” the L1’s financial and usage related metrics (at least in the short term). These metrics could see a rebound as more L2s go live and Ethereum continues to vertically integrate (e.g. through Based Sequencing).

How Should Investors Think About ETH Value Accrual?

- As a rule of thumb, the L1 asset of a given ecosystem tends to accrue the most value. Ideally, the native asset shares in the network’s economics, is used as money to pay for fees, and serves as a reserve or collateral asset in DeFi.

- ETH achieves economic sustainability when the yield earned by ETH holders exceeds the dilution that these holders experience from newly issued ETH.

- ETH as the most mature smart contract asset, tends to be a larger constituent vs. newer L1 tokens in many investor portfolios.

How Does Onchain Data Affect Investor Reporting and Protocol Accounting?

- Onchain data is a necessary component when constructing blockchain and application P&Ls and KPI reports. The most relevant metrics vary across chains: financial metrics are more relevant for mature chains, whereas developer activity and usage-related metrics tend to be more relevant for newer chains.

- Currently, onchain data is easily available, but in a fragmented and unstandardized format. Further, unlike in TradFi, there’s no self-regulatory organizations in crypto that would enforce industry-wide reporting standards.

- VanEck’s indexing company, MarketVector, has made efforts to create standards through different indexes (fundamentals, staking, etc). Given the high resource requirements for onchain data collection, the best way to ensure data correctness is to partner up with leading onchain data providers.

What’s Unique About Token Terminal’s Full-Stack Approach to Onchain Data?

- Token Terminal is a full-stack onchain data platform focused on standardizing financial and alternative data for the most widely used blockchains and decentralized applications.

- We ensure the best possible data quality, granularity, and accuracy through our vertically integrated data supply chain.

- Interested in working with industry-leading onchain data? Reach out to our sales team via people@tokenterminal.xyz.

How Do Regulators and TradFi Work With Onchain Data?

- We’re still some ways out from regulators actually incorporating onchain data more actively in their workflows.

- The adoption might start from tracking token ownership (cap tables), as we’ve seen with e.g. the BUIDL money market fund launched by BlackRock.

- Instead of accessing the data directly, regulators are likely to “read” onchain data via trusted middlemen, e.g. onchain data companies.

How Should Investors Construct Blockchain P&Ls?

- One mental model for most blockchains in the market today is that they’re Series A/B startups. This means that they’re not necessarily expected to be profitable, but instead optimize for rapid growth.

- Ethereum as the most mature network is (maybe) an exception to the above rule.

- In order to determine network-level profitability, investors should look at: transaction fees + MEV (that accrues to tokenholders) > new issuance.

The authors of this content, or members, affiliates, or stakeholders of Token Terminal may be participating or are invested in protocols or tokens mentioned herein. The foregoing statement acts as a disclosure of potential conflicts of interest and is not a recommendation to purchase or invest in any token or participate in any protocol. Token Terminal does not recommend any particular course of action in relation to any token or protocol. The content herein is meant purely for educational and informational purposes only, and should not be relied upon as financial, investment, legal, tax or any other professional or other advice. None of the content and information herein is presented to induce or to attempt to induce any reader or other person to buy, sell or hold any token or participate in any protocol or enter into, or offer to enter into, any agreement for or with a view to buying or selling any token or participating in any protocol. Statements made herein (including statements of opinion, if any) are wholly generic and not tailored to take into account the personal needs and unique circumstances of any reader or any other person. Readers are strongly urged to exercise caution and have regard to their own personal needs and circumstances before making any decision to buy or sell any token or participate in any protocol. Observations and views expressed herein may be changed by Token Terminal at any time without notice. Token Terminal accepts no liability whatsoever for any losses or liabilities arising from the use of or reliance on any of this content.

Stay in the loop

Join our mailing list to get the latest insights!

Continue reading

- Customer stories: Token Terminal’s Data Partnership with Linea

Customer stories: Token Terminal’s Data Partnership with Linea

Through its partnership with Token Terminal, Linea turns transparency into a competitive advantage and continues to build trust with its growing community.

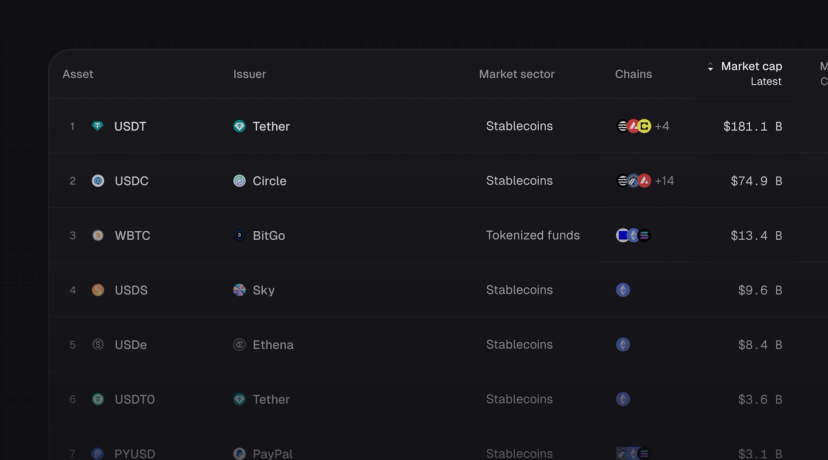

- Introducing Tokenized Assets

Introducing Tokenized Assets

Token Terminal is expanding its standardized onchain analytics to cover the rapidly growing category of tokenized real-world assets (RWAs) – starting with stablecoins, tokenized funds, and tokenized stocks.

- Customer stories: Token Terminal’s Data Partnership with EigenCloud

Customer stories: Token Terminal’s Data Partnership with EigenCloud

Through its partnership with Token Terminal, EigenCloud turns transparency into a competitive advantage and continues to build trust with its growing community.